Do you dream of retiring to sunny climates and enjoying a relaxed lifestyle? Have you always considered Panama, Thailand, or Portugal attractive destinations? – Then you are lucky because you can have your German pension transferred abroad.

Relocating as a pensioner can be a great way to make your dream come true. This blog article will look at the essential aspects of emigrating as a retiree, from the most popular destinations to the opportunities available to retirees abroad, to the challenges you may face. Let’s work together to find out if retiring abroad is right for you.

👉 Are you planning to move from Germany? We are your contact! With us, you can deregister from Germany online. We can also help you with other things related to resettling 🌍 – Take a look at our services & download our free checklist!

Why do many retired people in Germany think about resettling?

Are you wondering why so many German retirees are thinking about emigrating? Some of the most common reasons are the need for adventure and change, the search for a more pleasant climate, the opportunity to enjoy a higher standard of living with less money, and the chance to get to know the culture and people of other countries.

The number of retirees transferring their pensions abroad has increased. According to the Pensions Atlas of the German Pension Insurance, there will be around 248,000 pensioners in 2020. This is a new record for emigration – an increase of about 20 percent compared to 2010.

Since the pandemic, rising inflation and recession, the war in Ukraine, and so on, more and more people of all ages are considering emigrating. Want to know the most popular destinations and the most common reasons for German emigrants? We have summarised them in this article: Reasons why people leave Germany.

We have also written a blog post on the topic of “Where to move: The best countries for expats“.

In the following section, I will focus specifically on why pensioners leave Germany to spend their retirement abroad.

Climate and weather

Many people want to move to a country with a milder and more stable climate than Germany. Countries such as Spain, Portugal, or Thailand are popular destinations for retirees who want to enjoy warm weather all year round. A warmer climate can help you feel better and happier and improve your health and age-related symptoms through fresh air activities and more vitamin D. A warm and sunny place offers more opportunities for outdoor activities such as hiking, swimming, golf, and more. Compared to Germany, more opportunities for year-round leisure activities exist in more southern countries.

Cost of living

The cost of living is essential when moving abroad, as many retirees rely on a limited income in old age. A country with a lower cost of living will allow you to maintain a comfortable lifestyle, and you may even be able to afford a bigger house or a better car. The price of food, clothing, entertainment, and healthcare can also be lower, which is why more and more German seniors are choosing to live abroad.

Social and cultural aspects

Some retirees want to move to a country where the culture and way of life suit them better. They are looking for new experiences and adventures in retirement and want to spend their free time exploring a new country. Moving to another country offers the opportunity to learn about a new culture, make new friends, and integrate into a different society. Some also want to improve their language skills or learn a new language, which is easier in another country than in Germany. You may be looking for a community of people with similar interests and stages of life, such as a community of retirees or expats who support each other and share activities.

Security and health care abroad

One of the utmost important considerations during retirement is maintaining good health, as old age often brings various health challenges. For instance, in countries with a consistently warm climate, the impact of flu waves associated with autumn and winter weather tends to be less pronounced. Additionally, there are countries where healthcare systems excel beyond what is available in Germany. Several nations are renowned for their exceptional healthcare, including:

- USA (although costs are higher than in Germany)

- Canada

- Australia

- New Zealand

- Singapore

- Japan

- South Korea

- Taiwan

- Norway

- Sweden

- Finland

- The Netherlands

- Belgium

- Switzerland

- France

Another crucial factor to consider when contemplating retirement emigration is security. It is advisable to thoroughly research the current political and criminal landscape of the destination country and seek expert advice if needed. Certain countries may be more susceptible to natural disasters such as hurricanes, earthquakes, or floods, so proactively assessing and addressing these risks is essential. Additionally, gaining knowledge about the safety conditions of your desired location, including the availability of emergency services and medical care, is of utmost importance.

What happens to my pension if I leave Germany?

If you’re thinking about spending your retirement abroad, there are a few things you should consider. First, you must decide which country you want to go to. The German pension scheme gives you a free choice in this respect, as it pays pensions worldwide.

Germany has social security agreements with many countries that allow you, as a German pensioner, to continue to receive your money from Germany. If you want to migrate to a country that does not have a social security agreement with Germany, you can still count on your pension. There are simply no general rules on the recognition of pension rights. If you decide to move to such a country, you should find out about the conditions for pension payments in advance.

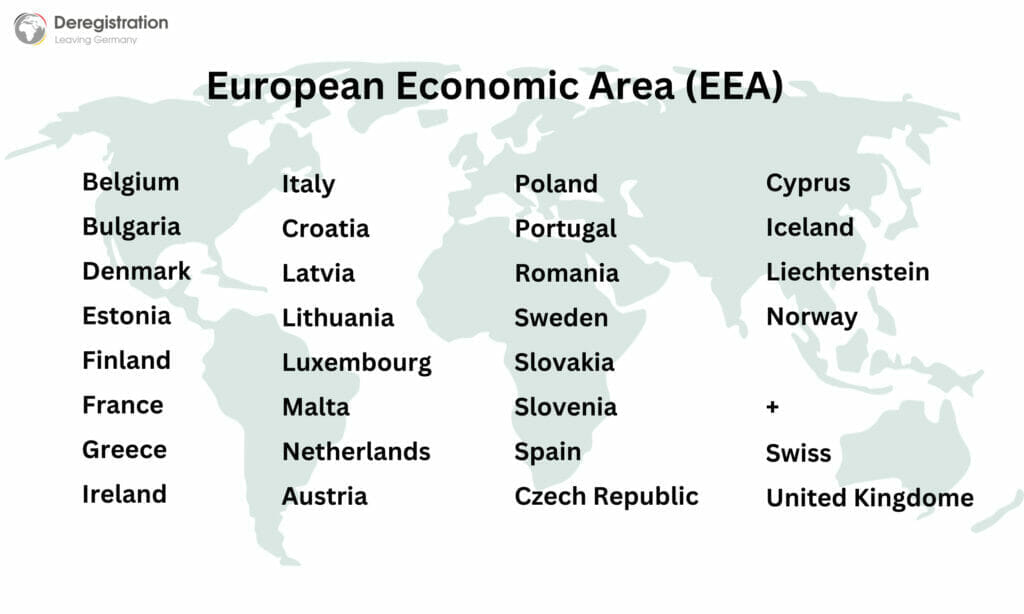

The following pictures show all the countries with a social security agreement with Germany. These are the European Economic Area and some other countries, such as Australia and the USA. (see Figure 2)

The contracting states you see at the bottom of the chart are all the countries that are not part of the European Economic Area but have a social security agreement with Germany. You can also have your pension contributions paid out in these countries:

Pension refund Germany: Who is eligible?

The German statutory pension system is not known for readily refunding contributions. To be eligible for a refund, certain requirements must be met.

The German pension scheme aims to encourage individuals to maintain their insurance relationship until retirement age, enabling the system to sustainably manage pension payments. However, this means that individuals who choose to receive a payout before retirement age will not have access to future retirement benefits. It is important to note that certain aspects of the refund process can be lengthy, complex, and confusing. Nevertheless, this rigorous approach ensures high safety standards and safeguards the substantial funds involved in the pension system.

Generally, only three groups of people can qualify for a pension refund:

- civil servants and those similar to them,

- those who have reached the standard retirement age but do not meet the general waiting period, and

- foreigners who have worked in Germany and have since emigrated. However, even within these groups, specific requirements must be met in order to be eligible for a refund.

The German pension system allows for early payment of contributions if the following three basic requirements are met:

- You are no longer required to pay contributions in Germany

- Your last contribution payment was made at least 24 months ago

- You do not have the option of paying into the German pension insurance scheme voluntarily.

The possibility of voluntary contributions to the pension insurance scheme depends on your nationality and current place of residence. The German Pension Insurance categorizes potential eligible individuals into four groups: German citizens, citizens of EEA countries, Switzerland, and the UK, individuals from contracting states, and individuals from non-contracting states.

Retiring abroad: All you need to know!

Your choice of retirement country will impact the amount of your state pension, even if the German pension scheme allows flexibility in selecting your destination. If you reside outside the eurozone, you may encounter conversion fees and exchange rate losses when receiving your pension. Additionally, transferring money abroad might incur additional costs. It is essential to consider whether transferring your pension to a German account you can access from abroad would be more advantageous. However, opening a bank account in Germany typically requires German residency, making it advisable to do so before your move.

Informing your pension and health insurance providers of your relocation at least three months in advance is crucial. Provide them with your new address, contact details, and bank information. Exploring account options in your chosen country is also recommended, paying close attention to associated costs and fees.

Furthermore, it is essential to note that most expatriate pensions are disbursed in European Union countries like Spain, France, and Switzerland. These countries have double taxation agreements with Germany, which can influence the amount of tax payable on your pension. Before your move, it is imperative to familiarize yourself with the tax implications in your destination country and ensure compliance with your tax obligations.

What is a double taxation treatment for pensions?

A double taxation agreement (DTA) is an agreement between two countries regulating the taxation of income and assets to ensure that a person is not taxed on the same income or assets in their home country and abroad.

Whether Germany can tax your pension depends on your current country of residence. If there is a treaty between your country of residence and Germany to avoid double taxation (a so-called double taxation treaty), Germany may be prevented from taxing your pension. In this case, the tax rate of your new country of residence will apply.

If both countries can tax, the double taxation treaty also regulates how your country of residence can avoid double taxation. Depending on which double taxation treaty applies, there are two ways to avoid double taxation: Your German pension is exempt from tax in your country of residence, or your country of residence must credit the German tax against the tax payable abroad.

Which countries do retired people prefer to relocate to?

Emigration is a financial motivation shared by Germans across various age groups. In particular, many retirees choose to move abroad during their golden years, enticed by the prospect of lower living costs and the desire to savor their ‘free years’ in idyllic holiday destinations. A crucial factor influencing this decision is the often insufficient average pensions in Germany, which struggle to keep pace with the escalating cost of living. As reported by the Stuttgarter Zeitung, the average retirement income in the old federal states stands at €1,620.90 gross, while it amounts to €1,598.40 gross in the new federal states (as of July 2022). After taxes and social security contributions, this translates to a net monthly amount of just over €1,400. Faced with this reality, many individuals perceive emigration as an opportunity to stretch their pensions further and enhance their overall quality of life.

This is a challenging question, as each emigrant leaves Germany for different reasons.

These are some of the most popular countries for German retirees:

- Panama: Panama is the best country to retire to, according to International Living’s ranking. The Central American country is best known for its famous canal linking the Atlantic and Pacific oceans. But it also has many other attractions, including a warm climate, varied landscapes, a well-developed healthcare system, and a low cost of living. The people’s well-developed infrastructure, hospitality, and friendliness are also praised. Last year, Panama came second to Costa Rica.

- Costa Rica: Costa Rica was ranked by International Living as the second-best country in the world for retirement. The country scored high on environmental protection, low cost of living, and good medical care. It is perfect for outdoor activities and has a good climate. According to International Living, a couple can live comfortably on around US$2,000-2,500 a month.

- Mexico: Mexico will be the most expat-friendly country in the world in 2022, according to Internations, and expats are delighted by the friendliness of its people. In addition, the cost of living is lower than in many Western countries, and there are many places where you can rent an apartment or buy a house for little money. According to statistics from the website WorldData.info, the cost of living in Mexico is 40% lower than in Germany.

- Thailand: Thailand is also one of the countries where you can enjoy your retirement the most! In Thailand, you can live very well on a small pension. Even €500 – €1000 per person is enough to live comfortably. Of course, it depends on the region and your lifestyle, but the average cost of living is much lower than in Germany.

- Canada: More and more retirees are also moving to Canada. The proximity to the USA, the excellent quality of life, and the security are reasons Canada is highly recommended for emigration.

Several countries within Europe are ideal for a relaxed retirement:

- Portugal has become increasingly popular in recent years, offering a high quality of life at an affordable price. Rents and property prices are comparatively low, and there are good deals on food and services.

- Spain, especially the southern and inland regions, offers an excellent opportunity to enjoy retirement as the cost of living is lower than in many other parts of Europe.

- Austria is another favored country for German retirees. The proximity to Germany, the similar culture, and the excellent quality of life are some of the reasons.

Here is an article from Focus Online on pension taxation abroad: Tax havens put to the test: These are the cheapest places to retire abroad.

Where can you live on €500 a month?

In certain countries, sustaining a monthly budget of €500 is possible. However, this feasibility depends on the desired standard of living and the type of lifestyle one wishes to pursue. A helpful indicator of countries with notably affordable living costs is the relatively modest average monthly salary the local population earns. For instance, the average wage in Bulgaria hovers around €400-500 per month, reflecting the country’s affordability. Similarly, Thailand presents a similar dynamic, where the average salary can vary greatly.

So you can live on a meager income or a small pension in the following countries:

- Countries like Mexico, Thailand, India, Vietnam, the Philippines, and other Asian countries generally have a meager cost of living.

- In European countries such as Bulgaria, Romania, the Czech Republic, Poland, and other Eastern European countries, you can also live on a meager budget.

- This is also possible in some South American countries such as Ecuador, Peru, or Bolivia.

How is my German pension taxed when I live abroad?

How your pension is taxed depends on how long you stay abroad. If you do not spend more than six months a year abroad, your stay is temporary, and your pension will continue to be paid to you as usual. From a tax point of view, nothing will change for you in this case; you will continue to be subject to unlimited tax liability in Germany on all your income, including your statutory pension.

However, if you spend more than six months a year abroad, this is considered a permanent residence. In this case, you are subject to limited tax liability in Germany, there is no basic tax-free allowance, and your taxable income is taxed from the first euro. Many benefits, such as spousal splitting and extraordinary burdens, are no longer considered. Tax allowances for children and single parents will also be abolished. These tax benefits are necessary for the tax burden on taxable income in Germany to be high. Before deciding to move overseas, learning about the effects of a permanent stay abroad on pension taxation is crucial.

Conclusion: Advantages of retirement emigration

Retirement emigration presents numerous advantages for individuals seeking a new life chapter. Among the most notable benefits are the opportunity to embark on a thrilling new adventure, significant cost savings resulting from a lower cost of living in foreign lands, the joy of basking in a pleasant year-round climate, and the rich tapestry of experiencing a different culture. Additionally, many countries provide exceptional healthcare facilities, ensuring retirees can maintain their well-being and happiness during this stage of life. The avoidance of double taxation on pensions, thanks to double taxation agreements, further amplifies the appeal of retirement emigration. It offers an extraordinary opportunity to embrace the enriching aspects of life and explore the vast wonders our world has to offer. Seize control of your destiny and follow your instincts toward a fulfilling retirement!

We are happy to assist you with any questions about relocating and deregistering in Germany! ☀️

Your Deregistration.de team.